American exceptionalism hasn’t come to an end, and we needn’t settle for 2% economic growth. What the U.S. needs is policies like Reagan’s, not Obama’s. By Phil Gramm and Michael Solon Dec. 1, 2017 6:40 p.m. ET The only sound basis for gauging the potential impact of public-policy changes is through...

Read more

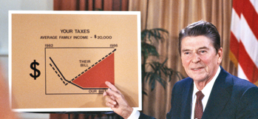

Don’t Be Fooled by ‘Secular Stagnation’