Arguments to the contrary spurn or wildly distort statistics and cherry-pick anecdotal examples.

By Phil Gramm and John F. Early

Feb. 25, 2020 7:19 pm ET

Even amid a freewheeling presidential primary, Democrats are of one mind when it comes to taxation: Rich Americans are not paying their fair share. Congressional Democrats have joined the debate, proposing a 10% surcharge on incomes above $2 million. Once imposed, the Democratic tax wish list could quickly grow into a massive drain on American families—much as the income tax grew in its first 50 years. What began in 1913 as a mere 7% levy on earnings above $500,000 (almost $13 million in 2019 dollars) rose by 1963 to a 72% tax on incomes above $44,000.

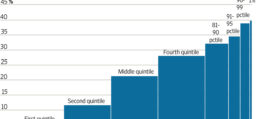

The claim that rich Americans pay a smaller share of their income in taxes than any other households is verifiably false. The nearby graph shows that taxes actually paid, as a percentage of income earned and received in transfer payments, rise steadily from 5.1% in the bottom quintile of households to 39.6% in the top 1%. While it’s too small to show on the graph, the top 0.1% of earners, which included 127,586 households in 2017, had an average gross income of $2,892,434 and paid $1,304,769, or 45.1%, in federal, state and local taxes.

To be sure, the average household in the top 1% retains almost 18 times as much income after taxes and transfer payments as the average bottom-quintile household. But it pays more than 219 times as much in taxes. Even at the very top of the income distribution, the average household in the top 0.1% has more than 31 times as much income as the average bottom-quintile household, but pays almost 482 times as much in total taxes.

Data from the Organization for Economic Cooperation and Development show that the U.S. has the most progressive income tax system in the world, with the top 10% of earners paying 45% of all income taxes, including Social Security and Medicare taxes, compared with only 28% in France and 27% in Sweden. If the U.S. government spent as large a share of gross domestic product and had the same tax structure as France, the top 10% of U.S. earners would pay about what they pay now in income taxes, but the bottom 90% would see their taxes almost double. Although the last OECD tax comparison was made in 2015, before the Tax Cuts and Jobs Act of 2017, the Joint Committee on Taxation has shown that the U.S. tax system, in terms of proportionate tax burden, became more progressive after the 2017 tax cut than it was in 2015.

On what basis then do Democrats argue that the rich don’t pay their fair share of taxes? They cherry-pick anecdotes of specific households that, because of the way they receive and use their income, fall far outside the statistical norm, and are in no way reflective of most taxpayers.

While Bill Gates’s tax returns have never been made public, he has reportedly given $45 billion to charity. It’s likely that he reduces his tax liability by giving away so much of his wealth. But it isn’t clear that the public interest would be served by taxing Mr. Gates more and leaving less for him to donate to private charities. To change Mr. Gates’s tax bill materially, Democrats could repeal the deductibility of charitable giving, but to date no candidate has made such a proposal.

Like Mr. Gates, Warren Buffett has donated billions to charity. And though he may be worth hundreds of millions of dollars a year to Berkshire Hathaway, he pays himself only a nominal salary. Because he rarely sells assets and makes considerable charitable donations, Mr. Buffett might, as he often says, actually pay a lower effective tax rate than his secretary.

The Buffett case illustrates the left’s argument that the megarich avoid taxes by simply avoiding income. Fair-minded people can debate whether a chronic wealth accumulator like Mr. Buffett, who spends so little of his wealth, is paying his fair share. But there’s a strong case to be made that he’s a public benefactor.

What is the purpose of taxation if not to serve the general welfare? To the degree that Mr. Buffett simply accumulates and does not consume, his wealth is creating jobs and promoting the general prosperity rather than benefiting him personally. Though sweeter and more generous than Ebenezer Scrooge, Mr. Buffett resembles the Victorian-era financier in his restrained consumption. Money was of no use to Scrooge because he didn’t spend it, but accumulators in his mold financed the investments that gave 19th-century England the highest living standards in the world. Would the public really be better off if government diverted Mr. Buffett’s billions from promoting general prosperity or Mr. Gates’s wealth from his charitable projects?

The claim that wealthy people don’t pay their fair share of taxes is revealing in that it fits a pattern of argument increasingly employed by the left. Their argument spurns or wildly distorts statistics, privileging anecdotal evidence instead. When you account for the $1.9 trillion in government transfers received annually by low-income Americans, it becomes clear that poverty has been nearly eliminated in the U.S. That assistance does not reach everyone; there are still visibly poor people living on the streets of San Francisco, Los Angeles and Austin, Texas. Yet instead of focusing on pragmatic solutions to increase housing stock and better serve people with mental illnesses, Democrats demand more redistribution.

America’s putative income inequality narrows dramatically when analysts count taxes and all transfer payments, and the American tax system is the most progressive in the world. But Democrats obsess about the Forbes 400 and call the tax system unjust.

The free-market system has raised billions of people out of poverty world-wide. Must it now be destroyed because some people fell through the cracks of the welfare system while a few contributed greatly to society’s well-being and reaped a part of what they produced? And by the way, where is socialism working today, and where has it ever worked?

Mr. Gramm is a former chairman of the Senate Banking Committee. Mr. Early served twice as assistant commissioner at the Bureau of Labor Statistics.