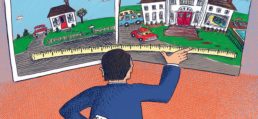

Usual measures of inflation don’t count the benefits of better products and more consumer choice.

By Phil Gramm and John Early

May 17, 2019 4:49 pm ET

Perhaps the most common indictment of America’s legendary prosperity is wage stagnation. Bureau of Labor Statistics data show that average hourly earnings of production and nonsupervisory employees peaked in October 1972 at $23.26 (in 2019 dollars) and were at that same level in March 2019. But do these numbers remotely describe the life you have lived over the past 45 years, or square in any way with numerous official measures of changes in what Americans actually own and consume? In short, should you believe your eyes or government data?

Compared with 1972, American homes today are much more spacious and modern. The proportion of homes today that have two or more rooms per person is up 33.5%. The share of homes with two or more bathrooms has more than doubled; central air-conditioning is more than three times as common; and the share of homes that have dishwashers is up by more than two-thirds. Most homes in 1972 had televisions, but only about half were color sets. Today they are all color and most are flat screens in high definition, attached to cable or satellites. The average home in 1972 had at least one phone, but none had cellphones or internet access.

Kitchens today are stocked with a far wider array of foods, including out-of-season fruits brought from half a world away and a vast variety of prepared foods. Compared with 1972, this abundance costs an ever smaller portion of families’ budgets, freeing up some $3,200 on average to spend on other things.

Cars last 81.3% longer and are 72.7% safer, and many have GPS navigation and premium sound systems. No standard model lacks air-conditioning or power steering. The share of the population with college degrees is almost three times as high. Americans live 7.4 years longer and their median age is almost 10 years older, yet the proportion of people reporting poor health is 20.3% lower. Real median household net worth is up 172.2%.

By virtually any definition of economic well-being, Americans are substantially better off today than they were a half-century ago. So how did we obtain this massive cornucopia of prosperity without a pay raise since 1972?

Part of the problem is that the BLS’s measure of average hourly earnings excludes employer-provided benefits, which now make up 30% of compensation. Counting the value of worker benefits adds 5% to the 46-year increase in total compensation.

More significant, the official index used to adjust for inflation—the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W—overstates actual inflation and understates real compensation. Nominal average hourly earnings rose from $3.99 in October 1972 to $23.26 this March, a 483% increase, but CPI-W also rose 483%, creating the reported stagnation in real average hourly earnings. While the CPI-W accurately measures changes in price for a fixed market basket of goods and services, it overestimates inflation because it fails to account for the substitution effect—how people change their consumption habits as relative prices change. Americans began to fly more often in the 1970s when the cost of airfare fell relative to the cost of ground transportation, for example, but the CPI-W missed this increase in consumer value by neither raising the weight it assigned to spending on air travel nor downgrading the weight for ground travel.

In contrast, the Commerce Department’s personal-consumption expenditures price index updates the market basket of goods and services monthly based on what people actually buy, allowing it to account partially for the substitution effect. Since 2000 the Federal Reserve has used this index to set monetary policy because it’s a more accurate measure of inflation. In designing the 2017 tax reform, Congress indexed the new income-tax brackets using a similar index to account for product substitution. Using the PCE price index rather than the conventional CPI-W to adjust compensation results in real hourly compensation levels that are 27.7% higher today than they were in 1972.

The biggest challenge in measuring real compensation and Americans’ well-being is the extraordinary growth in new products that have brought new benefits not captured in any government consumer price metric. The BLS does add new products to its index when they become widely used, but it often misses the initial price decline and understates the product’s impact on consumer welfare, including displacement of other, older products. The cellphone was first introduced as a specific item in the CPI-W in 1998. But because the device entered the index 14 years after the first public sale, the index never accounted for the preceding 75% drop in cellphone prices, nor the value of their lighter batteries and longer-lasting charge.

It may be impossible to discern perfectly what share of changes in the costs of goods and services comes from inflation compared with the share that comes from real increases in value. But in communications technology, for instance, it’s clear that no government metric comes close to capturing the full value of technology as America has progressed from the Pony Express to the telegraph, telephone, portable phone, cellphone and the smartphone.

Today 224 million Americans have at our fingertips more than two million apps, forecasting the weather anywhere in the world and showing us how to get anywhere we want to go. We communicate immediately without stationery or stamps or driving to the post office. We get medical advice without going to the doctor and obtain instantaneous access to more knowledge than is in the local library. We shop from our armchairs and work for companies thousands of miles away. Yet no government consumer-price index has ever come close to adjusting for the value embodied in this one of many miracle innovations.

Economists Bruce Meyer and James Sullivan attempted to correct for some of this problem in a 2013 study, integrating the findings of 52 different economic studies to develop a price index that adjusts more completely for changes in quality and innovation, as well as substitution. For example, using data from the American housing survey to quantify size and quality, they determined that the CPI overstates housing inflation by about 0.25% a year because it mistakes higher payments for bigger and better homes for real price increases.

They also used hedonic regression, a method of calculating implicit market prices for different features of an item, to demonstrate that the CPI overstates the yearly rate of increase in prices for personal electronic devices by as much as 5.8%. They corrected the CPI’s overestimation of the yearly rise in health-care costs by pricing based on treatment of a condition, as well as differences in outcomes such as survival, recovery and function.

Messrs. Meyer and Sullivan’s improvements are only a modest beginning of the needed revisions to traditional measures of inflation. Yet they provide convincing evidence that at a minimum, real compensation, in terms of the value of what we can actually buy, hasn’t stagnated since 1972, but instead has grown by at least 69.5%. For most of us who were around in 1972, that 69.5% increase more closely fits the world we live in.

The suggestion that America hasn’t gotten a raise in 46 years doesn’t pass the laugh test. Poor measurements of compensation are more than misleading; they also cause many voters and policy makers to favor redistribution that would depress growth and compensation. Nothing is more critical to promoting sound policy than measuring economic outcomes accurately. A nation is only as good as its facts.

Mr. Gramm is a former chairman of the Senate Banking Committee. Mr. Early served twice as assistant commissioner at the Bureau of Labor Statistics. This article is adapted from a forthcoming book with Bob Ekelund, “Freedom and Inequality.”